A top-tier accounting solution for Airbnb hosts & independent contractors

Shared Economy Tax is your trusted partner in tax services and accounting solutions tailored specifically to meet the unique needs of Airbnb hosts and independent contractors. Our team of accountants understands the distinct financial challenges and opportunities that come with operating in the sharing economy.

Whether you’re an enterprising Airbnb host managing short-term rentals or an independent contractor navigating the world of self-employment, our CPAs are here to help. We will provide you with the guidance, expertise, and support necessary to optimize your financial success. With a deep understanding of the tax implications, income reporting, and tax deductions relevant to the industry, our Airbnb accountants strive to empower you to make informed financial decisions, maximize your income, and minimize your tax liability.

List of Services

- Individual and Business Income Tax Return Preparation

- Entity Selection: Corporate and LLC Tax Reporting Structures and Setup

- Compliance with Local, State, and Federal Regulatory Requirements

- Tax and Estate Planning

- Quarterly Tax Payment Planning and Preparation

- IRS Audit and Defense

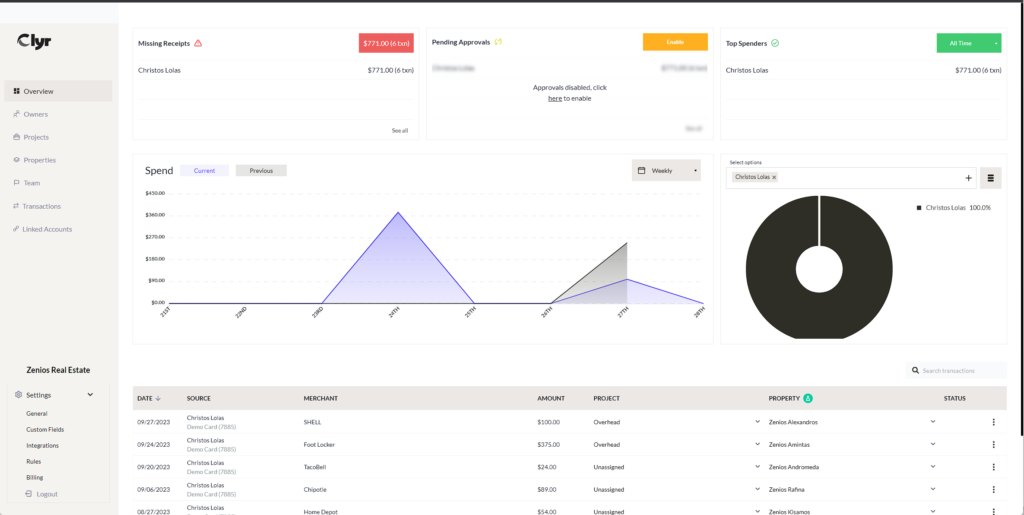

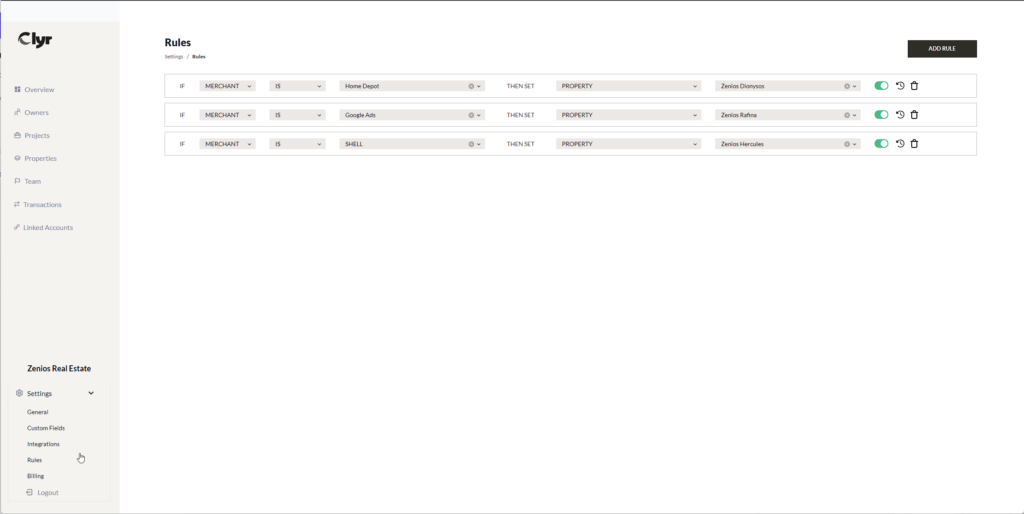

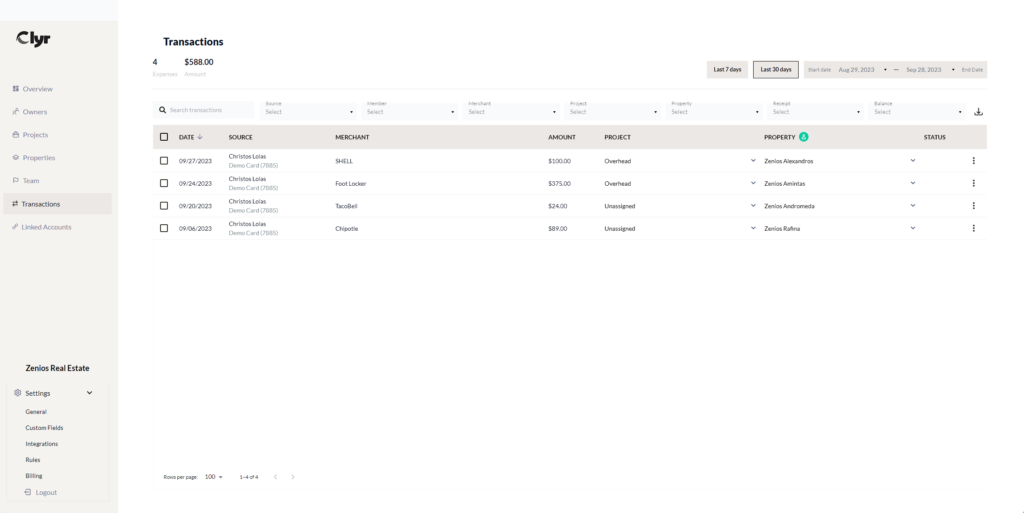

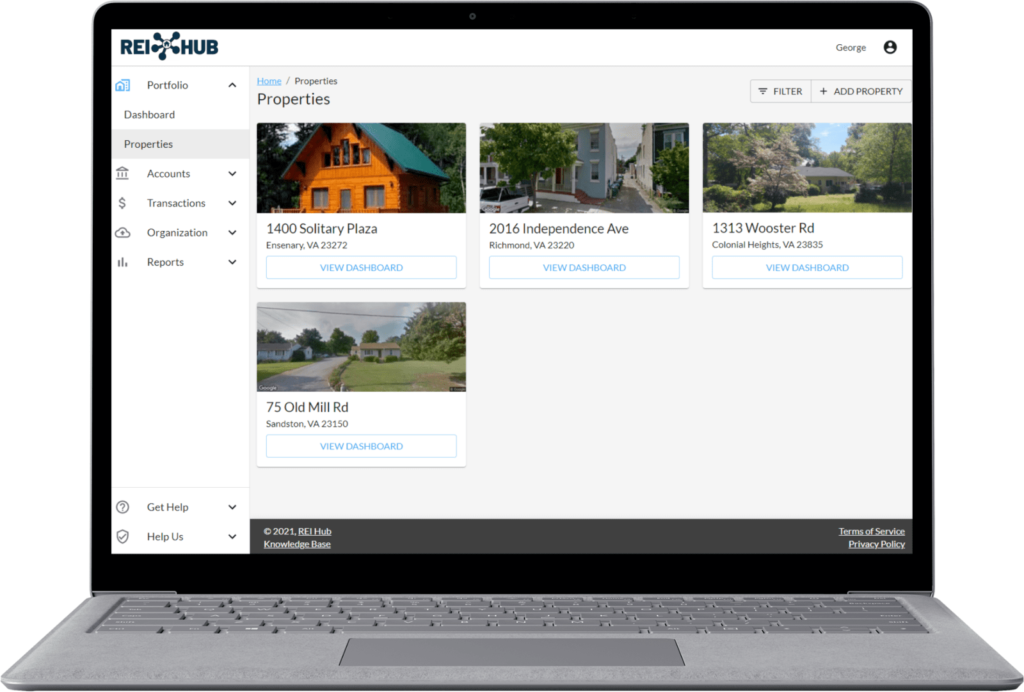

- Individual and Business Bookkeeping Services

- Tax Accountants for Freelancers

- Carshare and Turo Tax Preparation

- 1099 Contractor and Freelancer Tax Preparation

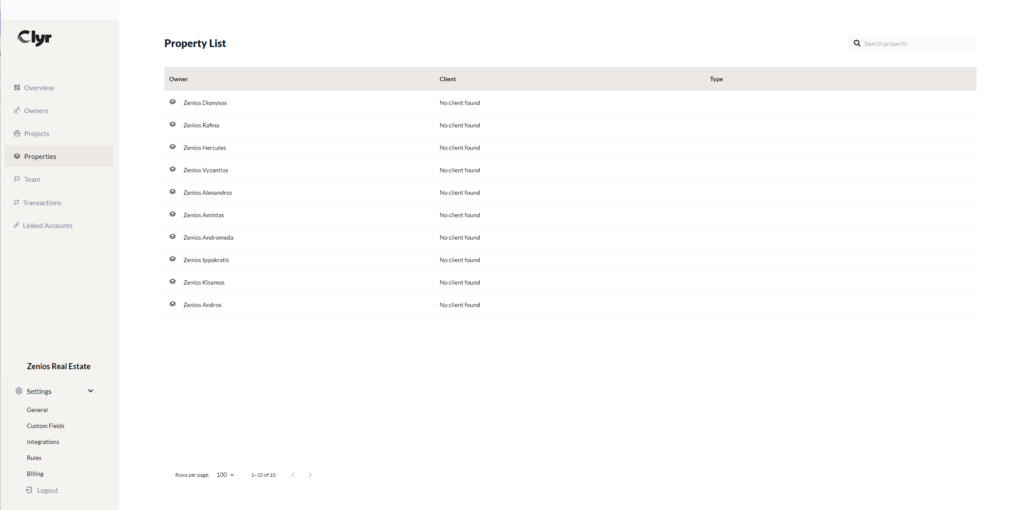

- Airbnb and Real Estate Investor Tax Preparation

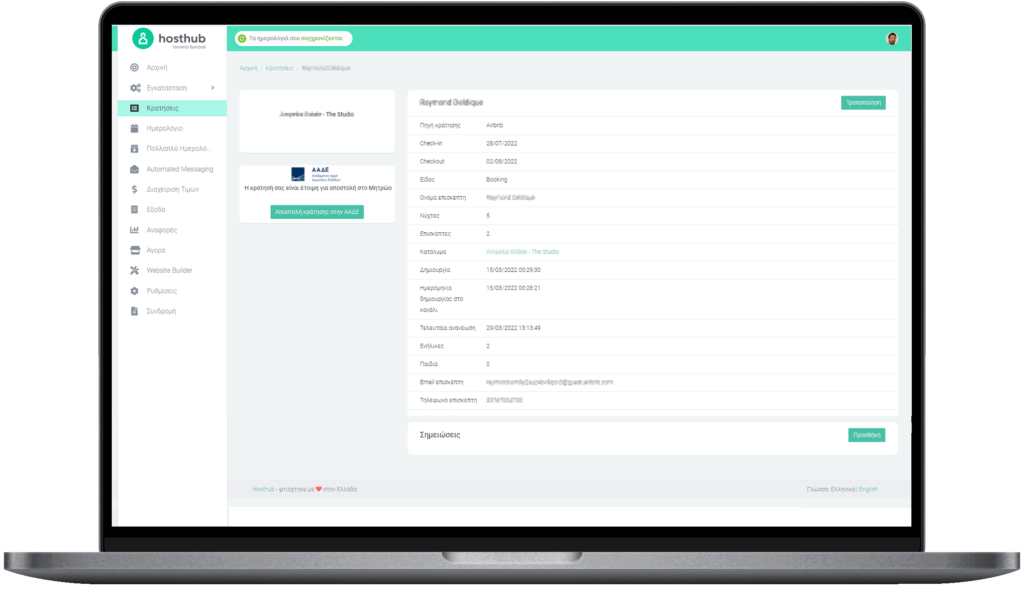

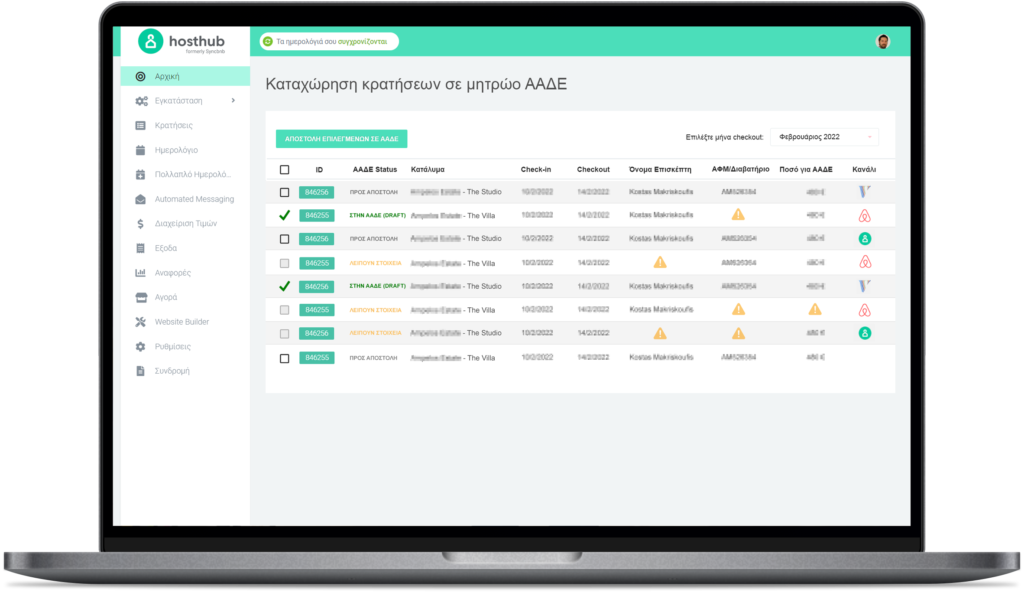

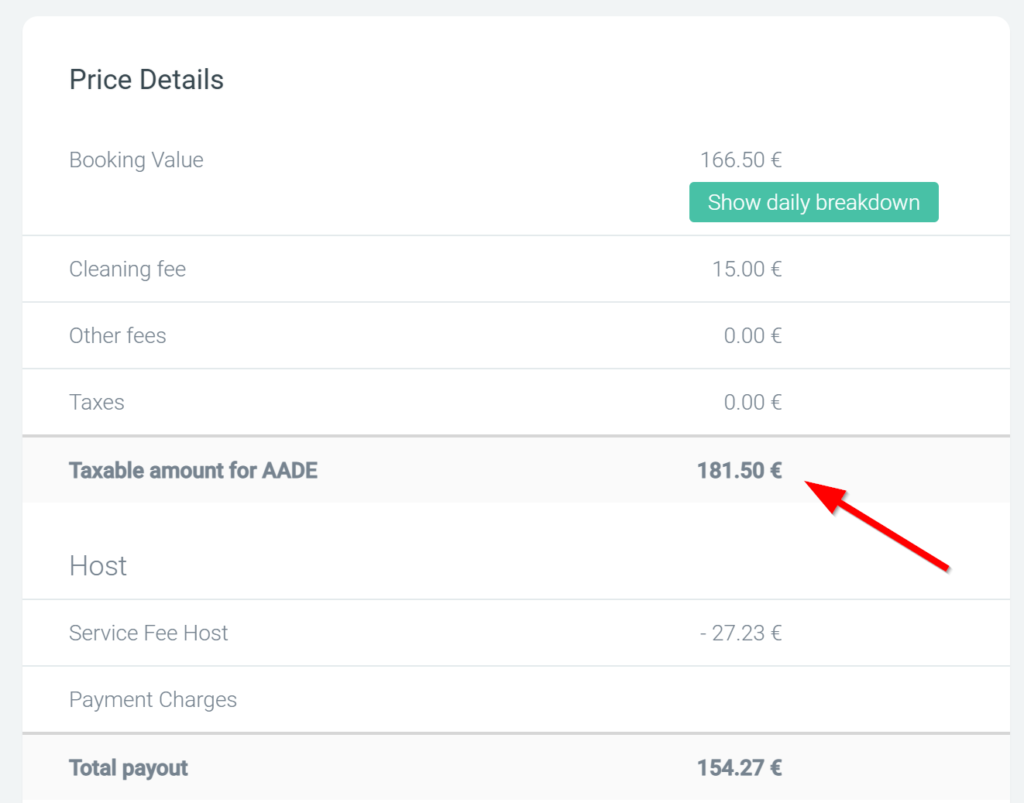

Discount for Hosthub users: All Hosthub users have free access to the TaxSense Online Course